Despite the looming Brexit uncertainty, the UK technology sector attracted more venture capital investment in 2018 than any other European country.

- Increased challenges for ICT resellers

- On average, payments take around 60 days

- ICT still bucking the overall insolvency trend

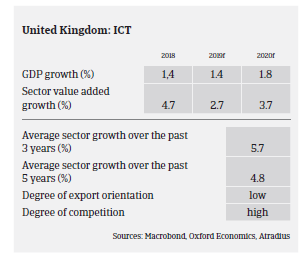

According to the analyst company Nelson Hall, spending of British businesses for IT and business process outsourcing (BPO) decreased 60% in 2018, to GBP 2.9 billion (down from GBP 5.1 billion in 2017). This decline was mainly due to increased insecurity over Brexit, which led companies to delay in-house investments, with budgets revised, plans postponed and non-essential upgrades delayed.

That said, the sharp decline was partly offest by a public sector investment surge of 68% in IT and BPO, up to GBP 2.9 billion. Central government departments accounted for 95% of the spending, with data centres, cloud infrastructure and application management being key areas of expenditure.

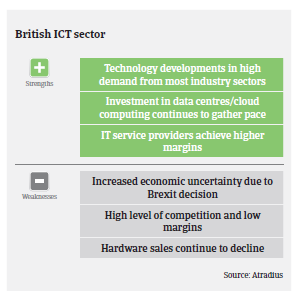

While ICT sales growth is expected to slow down this year, the business sentiment and outlook for 2019 in the industry is far more upbeat than in the rest of the economy. Despite the looming Brexit uncertainty, the UK technology sector again attracted more venture capital investment and stock market flotations in 2018 than any other European country. The high level of incoming investment is driven by a surge in funding for tech sectors such as financial technology, artificial intelligence, blockchain and cryptocurrency.

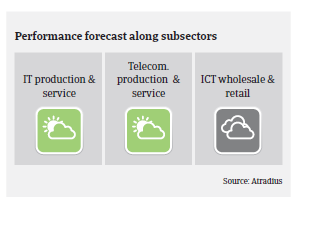

Software and data services remain the main drivers of ICT growth, together with cloud computing and the Internet of Things. Data centres, a continued development of mobile apps and new technologies like wearable devices are the areas anticipated to drive the sector forward in the coming years.

In 2018, ICT wholesalers and retailers continued to focus on increasing their software and services revenue streams as margins for hardware sales have diminished. Consumers are increasingly using smartphones as their only computing device, while technological improvements are not sufficient to generate real growth in the hardware segment. Pressure on margins persist across the IT industry as buyers are increasingly price-sensitive. This is a challenge for resellers that have not yet protected their customer base by moving to a more service-based model with more added value for clients.

Since 2017 there has been additional pressure on the margins of ICT businesses due to the pound sterling depreciation, which has reduced the purchasing power of many ICT companies that are importing/purchasing in EUR/USD and selling in GBP. While profitability of ICT businesses remains generally low, profit margins are not expected to deteriorate in 2019.

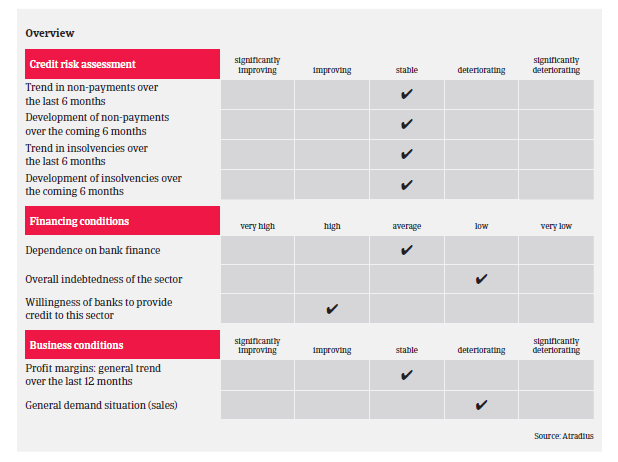

On average, payments in the British ICT sector remain unchanged at around 60 days. Payment experience over the past two years has remained good so far and the level of protracted payments is low. The number of non-payment cases has not increased over the last 12 months and this positive trend is expected to continue. The level of ICT insolvencies is average and no substantial increase is foreseen in 2019. ICT is bucking the overall insolvency trend as UK business failures are expected to increase 7% in 2019 after a 10% rise in 2019.

For the time being, our underwriting stance for the British ICT sector remains open to neutral. However, competition remains fierce and margins are expected to remain under pressure, with minimal barriers to entry.

Given the current economic conditions, we focus our discussions with buyers on foreign exchange hedging mechanisms/techniques adopted to ensure they are sufficiently covered, as many companies have not faced this risk over the past couple of years. In the wake of a no-deal Brexit, there could be price fluctuations on IT goods and immediate price increases from vendors. Adopting appropriate hedging mechanisms is vital for businesses to limit their risk exposure.

We continue to closely monitor ICT suppliers to the financial services sector, which is a major market for ICT sales in the UK. The potential relocation of financial institutions to mainland Europe in the wake of Brexit could have a knock-on effect on ICT suppliers. While the British government has sought to reassure major finance firms that the industry would be protected in a Brexit trade deal, the real outcome remains to be seen.

Kapcsolódó dokumentumok

1.13MB PDF