Still a red card: many payment delays, and construction insolvencies in both France and Romania are expected to remain on a very high level in 2016.

European football championship 2016

Sector playing field: construction industry

France: not yet up to win

Construction accounts for 4.9% of French GDP, with 540,000 companies employing about 1.5 million people. The sector consists mainly of small businesses (about 95% of construction businesses have 1-10 employees), with just about 200 companies employing more than 200 people, and some larger, internationally active players.

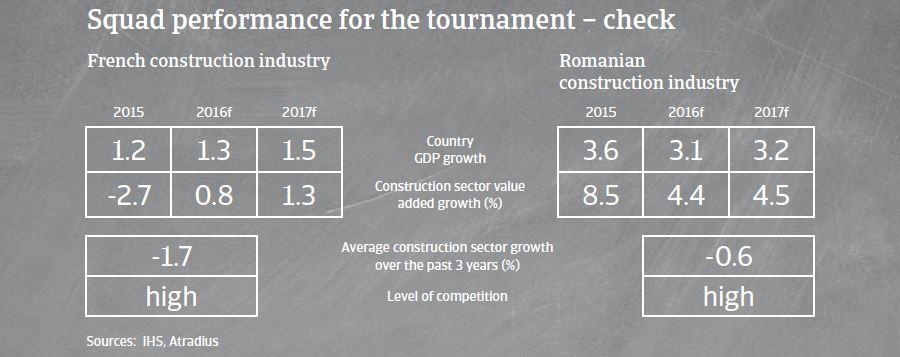

In 2015 French construction activity continued to deteriorate (down 3% in volume), the seventh year of decrease since the major recession of 2008. The sector was negatively impacted by still sluggish economic growth, low household purchasing and public budget spending constraints. In 2016, construction output is expected to rebound 2.5%.

Given the poor construction performance and low demand in previous years, it comes as no surprise that French construction businesses face many difficulties. Revenues and investments are low, competition is fierce, and prices and profitability are both being squeezed. Major players keep putting pressure on their subcontractors, and banks remain very selective with their loans, making access to short-term credit difficult. The adverse market conditions with strong competition and feeble demand prevent companies from price increases, while high personal costs weigh on businesses´ budgets. Due to continued difficult access to short-term credit facilities, cash management remains a major issue.

Romania: a mixed performance

The Romanian construction sector is a quite dynamic, with one of the highest growth rates in Europe. The volume of the construction works increased 9.9% year-on-year in the period January-September 2015.

Competition is strong and market consolidation on-going. Despite their size, many larger companies have faced financial difficulties in the past few years.

Many construction businesses show very low equity level. Main financing sources are suppliers and bank loans. But due to a high number of insolvencies and generally volatile market demand, banks are reluctant to provide loans to construction businesses. Financing of large projects is the key to success.

Although the economic environment and construction growth outlook are good, construction businesses are vulnerable to shocks and downturns, which are worsening the credit risk.

Players to watch

France

Residential construction activity is expected to grow 5.5%, helped by government support for new buildings and modernisation (e.g. tax exemptions and reductions for real estate investors and first-time buyers and VAT reduction for finishing) and increasing loans for real estate acquisitions by private households.

Non-residential construction activity is expected to remain subdued, especially in the public construction segment. Public works are likely to continue to suffer from poor investments: the government has reduced funds allocated to local authorities by nearly EUR 12 billion for the period 2015-2017 (approx. EUR 4 billion per year) as part of an overall cost cutting program of EUR 50 billion over three years to tackle the public deficit.

Romania

Investment in the commercial construction segment is expected to increase. The rising focus on energy efficiency and installation of modern heating, ventilating, and air conditioning (HVAC) systems will fuel growth of this subsector.

The residential construction segment has been relatively flat since a couple of years. Currently there is no sign of a significant improvement.

The construction materials segment is highly vulnerable to fraudulent behaviour, due to the generally low level of profit.

Major strengths and weaknesses

French construction industry: strengths

Romanian construction industry: strengths

- Structural lack of housing due to the demographic development (growing population)

- Still low interest rates

- Increase of foreign direct investment (FDI) in construction and real estate in Romania

- Government focus on road infrastructure development will support economic growth

- Decreased credit costs

French construction industry: weaknesses

Romanian construction industry: weaknesses

- Feeble economic growth and measures to curb the high public deficit

- Slow rebound underway, but still low order books, especially in Public Works

- High unemployment

- Costs rising faster than prices

- Relatively high risk operating environment for construction businesses due to lack of transparence in tender processes and endemic project delays

- Corruption is widespread, damaging the reputation of the industry

- Inability of the authorities to promote public-private partnership projects

Fair play ranking: payment behaviour and insolvencies

French construction industry

Payment experience in the French construction sector is bad, and the level of protracted payments has been high over the past couple of years.

The number of non-payment notifications is high, and has increased in 2015. A stabilisation is expected in 2016, but the level of non-payments will remain high.

The financial situation of construction businesses is often impacted by the ‘scissor effect’ of low margins and long payment delays.

The number on insolvencies in the industry is expected to remain stable, but still on a very high level.

Romanian construction industry

Payment duration in the construction sector takes about 60 days–-120 days on average.

As works usually take an extended amount of time to be completed, many construction businesses heavily rely on protracted payments, which increases the credit risk.

In the public construction segment the administration is generally very slow in paying for completed works, which is putting stress on the liquidity of businesses

The number of construction insolvencies is very high and has increased over the past six months, and are expected to level off only in the coming six months.