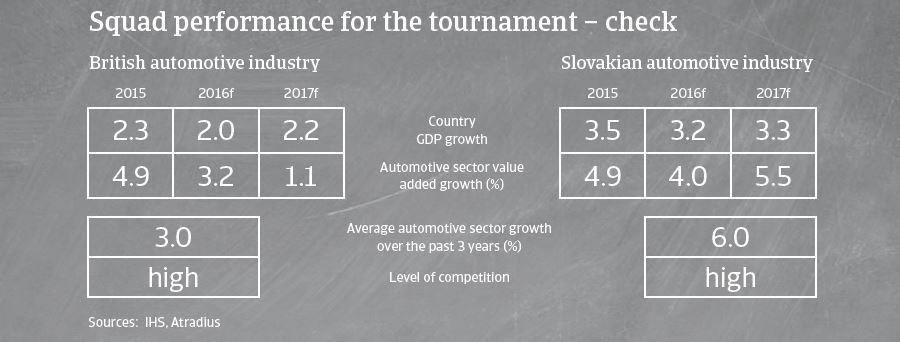

A draw in sector comparison, as both the Slovakian and the UK automotive industry show a robust performance. Payment behaviour is generally good.

European football championship 2016

Sector playing field: automotive industry

Wales/United Kingdom: upswings in both football and industry performance

The Welsh football team has seen an upswing in recent years, culminating in the first qualification for a European football championship ever in 2016. This resembles, somehow, the rebound of the British car industry. This sector has grown four years in a row, mainly helped by cheaper finance and stronger exports. Car manufacturing reached a ten year high in 2015, growing 3.9% year-on-year to 1,587,677 vehicles. Both domestic car production and domestic car registrations have continued to grow further in the first months of 2016.

As more than 77% of all cars produced in the UK are exported, it is expected that manufacturers will continue to benefit from continued growth in car sales in Western Europe. An increase of 4.7% is expected in 2016 and 3.1% in 2017. Demand from China for UK-manufactured cars is also expected to increase further.

That said, despite the benign outlook for the time being, the industry remains very susceptible to global economic volatility.Slovakia: major milestones achieved

Just like the first qualification of Slovakia´s team for a European football championship was a major milestone, the country´s automotive industry broke a record in 2015 producing more than a million cars for the first time. The country is the global leader in car production per capita (184 cars per 1,000 inhabitants in 2015). The automotive industry accounts for 45% of Slovakia´s manufacturing activities and 35% of exports. With another increase in car sales forecast for Europe in 2016, the Slovakian automotive industry is expected to benefit. At the same time domestic car sales are expected to remain robust. Profit margins of vehicle manufacturers are expected to increase further in the coming months due to robust sales, lower costs for steel and plastics and improving efficiency in the production process. However due to its high dependence on exports the Slovakian automotive sector remains highly susceptible to adverse developments in the global car market, e.g. a major slump of demand in China.

Players to watch

Wales/United Kingdom

British car producers continue to do well. Car producers like Jaguar Land Rover continue to be successful and, this is having a positive effect on the automotive supply chain segment. This resembles somehow the pivotal role Real Madrid´s Gareth Bale, together with Arsenal´s Aaron Ramsey and Liverpool´s Joe Allen, plays for the whole Welsh team.

Investment in the car producers sector is expected to increase further, e.g. demonstrated by the plan of McLaren automotive to invest GBP 1 billion in the coming years.

With demand growing, new car sales continue to be strong, and the British car retailers segment is posting increased profits.

Slovakia

The Slovakian automotive suppliers segment widely benefits from decreased commodity costs and rising demand. Jaguar Land Rover has decided to build a new plant in Slovakia with production expected to start in 2018 (planned are 150,000 cars per year at the start). This will further increase demand from local car parts suppliers.

Major strengths and weaknesses

British automotive industry: strengths

Slovakian automotive industry: strengths

- Continued strong demand for UK built cars domestically and in Western Europe

- Increasing demand in North America

- Increased profit outlook for businesses throughout all segments

- Significant benefits realized from low commodity (steel) prices

- Many British carmakers restructured after the 2008 credit crisis and are as a consequence financially more resilient

- Due to high capital investment requirements, new companies find it difficult to enter the automotive market

- Close proximity to core export markets in Europe

- Low labour costs

- Industry benefits from government support

- Financial institutions are willing to lend

British automotive industry: weaknesses

Slovakian automotive industry: weaknesses

- High fixed costs and necessary investment in research and development

- High operating leverage magnifies gains and losses, making earnings sensitive to sales.

- Highly competitive industry with overcapacities and heavy discounting impacting profit margins

- Deteriorating sales to Brazil and Russia

- High export dependence makes the industry very vulnerable to international economic volatility

- More segments need to increase added value and/or quality

Fair play ranking: payment behaviour and insolvencies

British automotive industry

On average, payments in the British automotive sector take around 60 days.

Payment experience is very good, and the level of protracted payments is low.

The number of non-payment cases decreased in 2015, and this positive trend is expected to continue in 2016.

With increasing demand and increased profit margins the level of automotive insolvencies is low, and this is expected to remain unchanged in 2016.

Slovakian automotive industry

Depending on the level in the supply chain, payment duration in the automotive sector ranges between 30 days and 60 days.

Payment behaviour is generally good with a low number of non-payment notificiations, and this is expected to remain unchanged in the coming months.

The insolvency level in this industry is expected to remain low after decreasing over the last six months.