Payment delays and business failures are expected to increase modestly in the coming twelve months, especially in the metal manufacturing segment.

- A less benign performance outlook

- A modest insolvency increase is expected

- Payments take 80 days on average

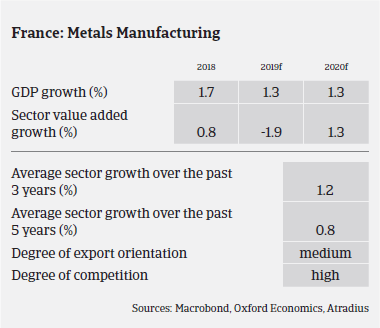

In H1 of 2019 demand for French metals and steel from the construction industry remained quite stable despite the fact that the building industry faced some difficulties. The automotive sector rebounded following poor performance in Q4 of 2018. Metals and steel demand from the machinery industry was driven by solid demand with increased exports.

The French metals and steel sector is mainly dependent on domestic demand, less so on exports. The impact of the US import tariffs on steel and aluminium remains low (the US market accounts for only 4% of French steel and metals exports).

However, the performance outlook is less benign for the coming 12 months. In the construction sector we have noticed some delays of major projects. This is impacting deliveries, payment terms and the cash flow of affected metals and steel suppliers. At the same time, metals and steel demand from domestic automotive producers is expected to decrease sharply in the coming months. At least demand from machinery remains robust, despite reduced activity in the farming machines/equipment segment.

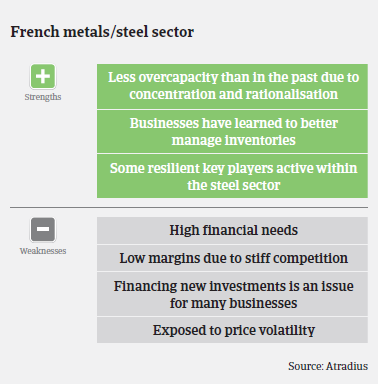

Operating margins generally remain small for many small players, especially for smaller steel/metal traders, wholesalers and processors. Profit margins of these businesses continue to deteriorate as sales prices have decreased. That said, many traders have learned to prudently manage their inventories over the past couple of years, and are better prepared to cope with commodity and sales price volatility.

Metals and steel businesses are generally highly dependent on bank financing, due to high capital expenditures when operating upstream, and/or the need for short-term facilities to finance working capital requirements and inventories. The willingness of banks to provide credit to the sector has remained unchanged since last year, and can be described as neutral.

The average payment duration in the metals and steel industry is 80 days. Payment delays and insolvencies are expected to increase slightly in the coming 12 months. While metal and steel traders and wholesalers are able to adapt with a flexible cost structure, we expect more business failures in the metal manufacturing segment, which suffers from decreasing demand (especially from automotive). Insolvencies in the industry are expected to increase by about 1%-2% in 2019 and 2% in 2020, as heavier working capital requirements are putting pressure on cash flow and liquidity of producers. Additionally, investments recently made by some companies to increase their business activity could lead to overcapacity.

Our underwriting stance remains generally open for the iron and steel segment, considering the quality of the portfolio (larger businesses with strong fundamentals). However, we are more cautious with businesses in the recycling segment due to ongoing price volatility.

Our underwriting stance remains neutral for metal trading business, considering persistent price and competition issues, while many players have improved their inventory management. A neutral approach also applies to the metals manufacturing segment, where capacity problems, cash flow pressure, difficulties absorbing new investments and decreasing demand from key buyers are issues. We are closely monitoring small and mid-sized manufacturers that deliver to the automotive industry, as demand from this buyer sector is expected to decrease sharply (production of related automotive components could decline by about 20% in 2020). We pay close attention to businesses active in the forging segment, which is seriously impacted by the shift away from combustion (Diesel) engines, and has comprehensive financing needs in order to climb up the value chain.

In the steel and metals industry, where both overcapacity and volatile prices are a concern, conditions can change quickly, especially if decreasing revenues and margins are not bolstered (in time) by cost management. Prudent inventory management has become a key factor for cost optimisation and absorbing sudden price decreases.

Kapcsolódó dokumentumok

1.06MB PDF